Clariant reports progressively improving operating profitability and a strong cash flow during a challenging 2009

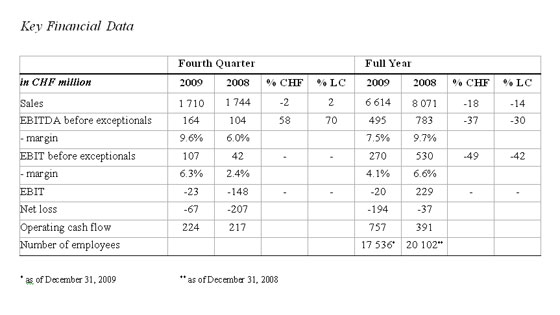

★Sales in 2009 down 14% in local currency and 18% in CHF

★Operating income before exceptional items decreased to CHF 270 million in 2009 from CHF 530 million in 2008

★Cash flow from operations improved to CHF 757 million from CHF 391 million in the previous year

★Net debt reduced to CHF 545 million from CHF 1,209 million in 2008

★As part of the ongoing asset network optimization program, further measures are being implemented, affecting production sites in Muttenz (Switzerland), Resende (Brazil) and Thane (India)

★Outlook 2010: Clariant does not foresee a sustainable recovery of the global economy. As a consequence, Clariant expects sales growth in local currencies in the low single-digit range. The operating income margin before exceptionals is expected to rise above 6%. Cash flow from operations will remain strong but below the levels of 2009.

CEO Hariolf Kottmann commented: “During the year we have successfully focused on generating cash, decreasing costs and reducing complexity. In an economic environment that is still challenging, we will continue to focus on our restructuring efforts. The aim remains to achieve sustainable above industry-average profitability by the end of 2010 and to create a solid platform for profitable growth in the years thereafter.”

Clariant today announced sales of CHF 6.614 billion in the full-year 2009, compared to CHF 8.071 billion in 2008. This represents a decline of 18% in Swiss francs or 14% in local currency.

The significant drop in sales reflected the severe economic crisis that affected all businesses across all regions. At the beginning of the year, sales were severely impacted by lower demand levels, resulting in significant capacity underutilization and leading to a depressed gross margin in the first quarter. As the year progressed, capacity utilizations rose as sales volumes improved quarter-by-quarter, therefore reducing capacity underutilization costs. In addition, the company took decisive measures to address production overcapacity such as temporary shutdowns, short time work or involuntary vacation. Through strong price management, Clariant was able to maintain sales prices at 2008 levels, while on the other hand raw material prices were lower. As a result, the gross margin for the full year was 28.2%, only slightly lower compared to the 2008 margin of 28.7%.

In 2009, Clariant focused on the reduction of Sales, General & Administration (SG&A) costs. In absolute terms, SG&A costs decreased to CHF 1.47 billion from CHF 1.64 billion in the previous year. The SG&A cost in percentage of sales increased to 22.2% from 20.3% as a result of lower sales. Consequently the operating income (EBIT) before exceptional items reached CHF 270 million compared to CHF 530 million in the previous year leading to an EBIT margin of 4.1% compared to 6.6% in 2008. Throughout 2009 the operating income before exceptional items improved quarter-by-quarter.

All divisions saw a slight recovery in demand in the second half of the year, although to varying degrees. Based on their decisive restructuring and cost cutting measures, they all contributed positively to the operational income before exceptional items.